One of the commonly used incoterms is DDP, which stands for Delivery Duty Paid. In this blog post, we will delve into how DDP Incoterm works, its advantages and disadvantages, as well as debunking some common misconceptions surrounding it. So grab a cup of coffee and let’s dive right in!

How does DDP Incoterm work?

The DDP Incoterm, or Delivery Duty Paid, is a term used in international trade to specify the responsibilities and obligations of both the buyer and seller during the transportation of goods. Under this incoterm, it is the seller’s responsibility to arrange and pay for all costs involved in delivering the goods to the agreed-upon destination.

When using DDP Incoterm, the seller takes on a greater level of responsibility compared to other terms. They are responsible for not only ensuring that the goods are properly packaged and loaded onto transport vehicles but also for arranging necessary documentation such as export licenses or customs clearance.

In addition, under DDP Incoterm, any import duties or taxes that may be applicable in the buyer’s country are also covered by the seller. This means that once delivered to the buyer’s premises, they can simply receive their shipment without worrying about additional charges.

It’s important to note that while DDP simplifies things for buyers by taking care of most aspects related to transportation and customs clearance, it does come with some drawbacks. For instance, sellers may need extensive knowledge of various countries’ import regulations and taxation systems. Failure to comply with these requirements could lead to delays or penalties.

Understanding how DDP Incoterm works is essential when engaging in international trade. It allows for smoother transactions between parties involved while providing clarity regarding each party’s responsibilities throughout every stage of delivery.

Advantages and Disadvantages of using DDP Incoterm

DDP Incoterm, which stands for Delivery Duty Paid, is an international trade term that places almost all responsibility and risk on the seller. Let’s explore some advantages and disadvantages of using DDP Incoterm in your business transactions.

One major advantage of DDP is that it offers convenience to the buyer. With this incoterm, the seller takes care of all aspects related to shipping, including transportation costs, customs clearance, import duties, and taxes. This means less hassle for the buyer who can focus on other important tasks.

Another advantage is that it provides clarity in terms of cost allocation. The buyer knows exactly what they are paying for since all expenses associated with delivery are included in the price. This can help avoid any unexpected or additional charges down the line.

However, there are also some disadvantages to consider when using DDP Incoterm. One potential downside is that sellers may pass on higher costs to buyers due to their increased responsibilities. As a result, buyers might end up paying more compared to other incoterms where certain costs are shared between both parties.

Additionally, relying solely on DDP can lead to longer transit times as sellers handle every aspect of shipping independently. Delays in customs clearance or gathering necessary documentation could prolong delivery times and impact customer satisfaction.

Common misconceptions about DDP Incoterm

While the DDP Incoterm can be a valuable option for many businesses, there are some common misconceptions that need to be addressed. Let’s take a closer look at these misunderstandings:

1. DDP means no additional costs or fees: One of the biggest misconceptions about DDP is that it guarantees no additional costs or fees beyond the initial purchase price. However, this is not always the case. While the seller is responsible for paying duties and taxes in the buyer’s country, other charges such as storage fees, demurrage, or local handling charges may still apply.

2. The seller takes full responsibility for all risks: While it’s true that under DDP terms, the seller is responsible for delivering goods to the buyer’s named place of destination and bearing all risks until then, it doesn’t mean they are liable for any unforeseen circumstances beyond their control. For example, if customs clearance delays occur due to issues unrelated to the seller’s actions or negligence.

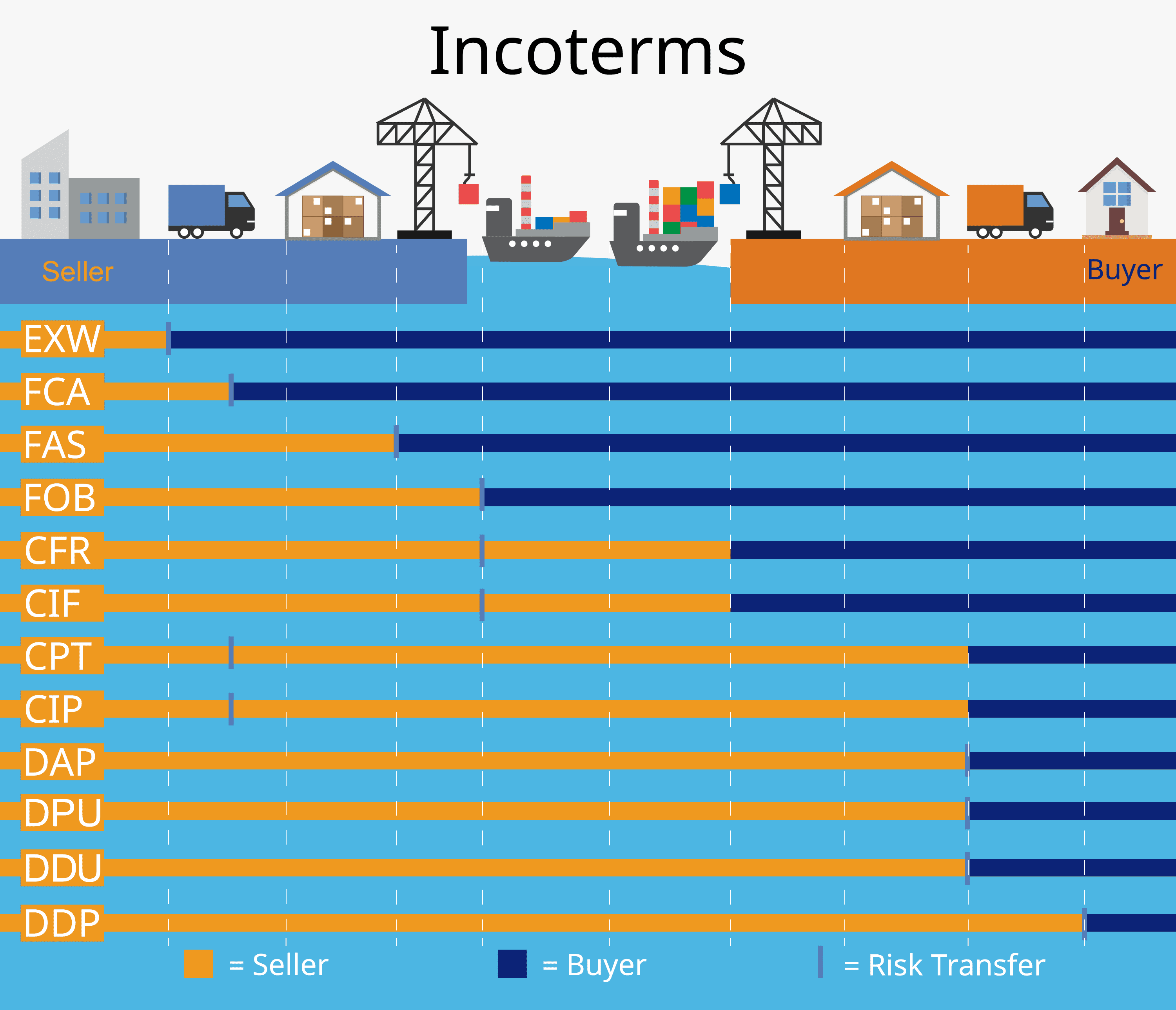

3. DDP Incoterm works well for all international transactions: It’s important to understand that using DDP may not always be suitable for every international transaction. Factors such as complex customs regulations in certain countries or high import duties could make using DDP less favorable compared to other incoterms like EXW (Ex Works) or FCA (Free Carrier). It is crucial to assess each situation individually based on specific requirements and circumstances.

4. DDP eliminates communication and coordination with freight forwarders: While sellers assume responsibility for arranging transportation under DDP terms, it doesn’t mean they can bypass freight forwarders altogether. Freight forwarding companies play an essential role in navigating complex logistics networks and ensuring smooth transit operations from origin to destination.