Welcome to our blog post on the CFR Incoterm – a vital term in international trade that can make or break your shipping arrangements! If you’re new to the world of logistics and shipping, don’t worry. We’ve got you covered with all the information you need to understand how CFR works and why it’s essential for successful global trade.

Whether you’re an importer, exporter, or just curious about the ins and outs of international business transactions, this article will shed light on the meaning and use of CFR Incoterm.

How Does CFR Work?

CFR, which stands for Cost and Freight, is an Incoterm that defines the responsibilities and obligations of both the buyer and the seller in international shipping transactions. Under CFR terms, the seller is responsible for delivering the goods to a specified port of destination and covering all costs involved in transporting them there. This includes not only freight charges but also any necessary documentation, customs fees, and export duties.

Once the goods have been loaded onto the vessel at the port of origin, it is then up to the buyer to bear any risks or expenses associated with loss or damage during transit. The title and ownership of goods pass from seller to buyer when they are loaded onto the ship.

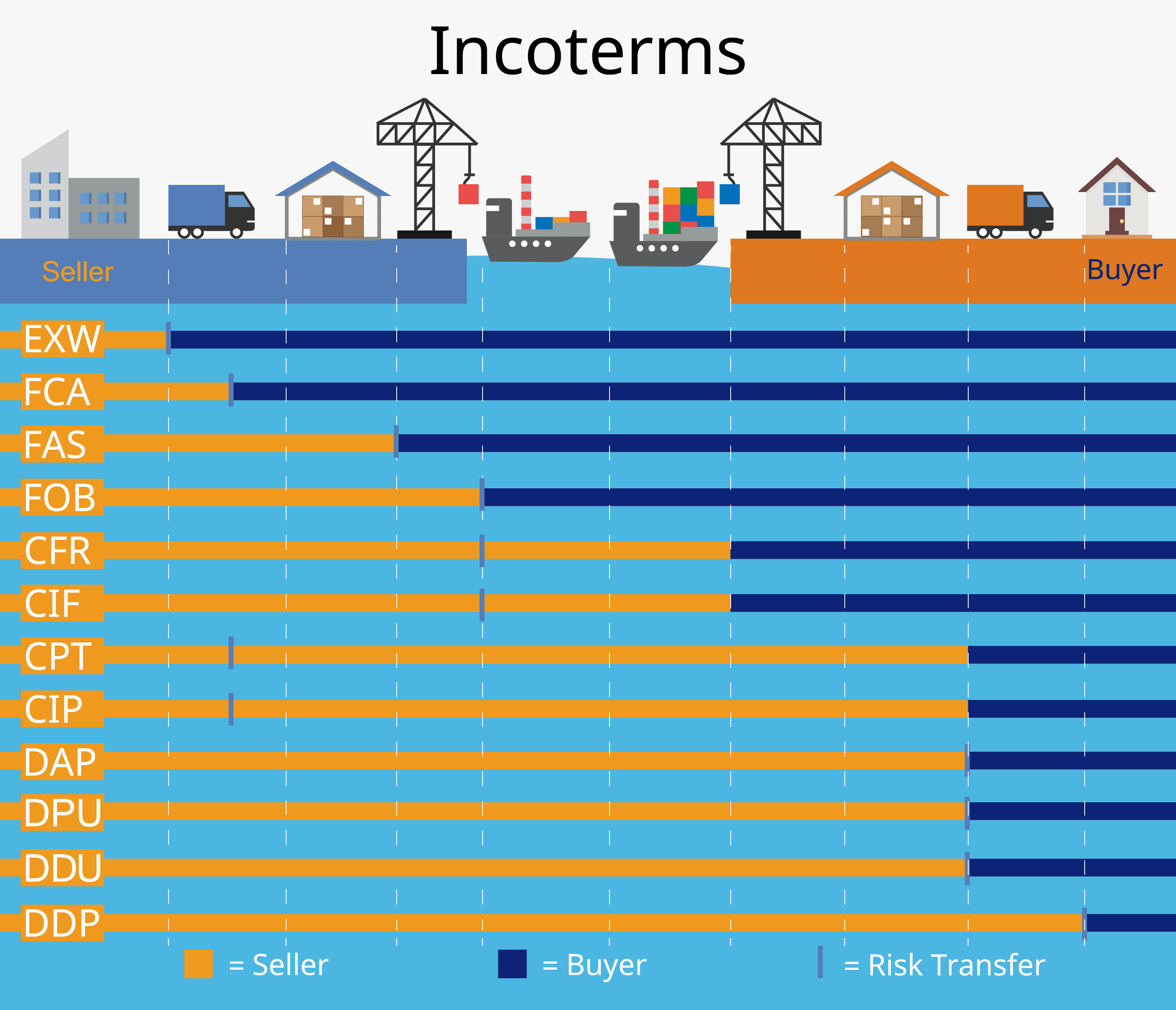

It’s important to note that CFR only applies to transportation by sea or inland waterways. If you’re dealing with other modes of transport such as air or road, different Incoterms like CIP (Carriage and Insurance Paid) or DAP (Delivered at Place) would be more suitable.

CFR provides a clear framework for allocating responsibilities between buyers and sellers when it comes to shipping costs. It ensures transparency in determining who bears which risks throughout each stage of transportation until delivery at the designated port. Understanding how CFR works can help businesses navigate international trade smoothly while minimizing disputes and uncertainties along their supply chain journey.

Advantages and Disadvantages of Using CFR

1. Cost-effective Shipping: One of the major advantages of using CFR is that it allows the buyer to have more control over transportation costs. Since the seller is responsible for arranging and paying for freight, the buyer can negotiate better rates and potentially save on shipping expenses.

2. Clear Responsibilities: CFR provides a clear division of responsibilities between the buyer and seller. The seller takes care of delivering the goods to the named port, handling export procedures, and covering transport costs up until this point. This clarity helps both parties understand their obligations and reduces the risk of misunderstandings or disputes.

3. Reduced Risk: With CFR, the seller bears most of the risk associated with transporting goods until they reach the named destination port. In case any loss or damage occurs during transit, it is typically covered by insurance arranged by either party as per their agreement.

Disadvantages of Using CFR Incoterm:

1. Limited Control: As a buyer using CFR, you have limited control over certain aspects such as choice of carrier or routing options since these decisions are made by the seller who arranges transportation.

2. Customs Formalities: Importing goods under CFR incoterm requires buyers to handle various customs clearance procedures at their end, which can be time-consuming and complex if not well-versed in international trade regulations.

3. Higher Insurance Costs: While sellers usually obtain marine insurance coverage under CIF (Cost, Insurance & Freight), when using CFR incoterm buyers need to arrange separate insurance coverage for protecting their interests during shipment which may lead to higher insurance costs.

Remember that understanding both advantages and disadvantages will help you determine whether using CFR incoterm aligns with your business requirements!

Difference Between CFR and Other Incoterms

Understanding the CFR Incoterm (Cost and Freight) is crucial for businesses involved in international trade. This Incoterm provides clarity on the responsibilities and costs associated with shipping goods from the seller to the buyer.

By using CFR, sellers are responsible for delivering the goods to a specified port of shipment and covering the costs of loading them onto a vessel. The risk then transfers to the buyer once the goods have been loaded. This arrangement allows both parties to clearly understand their obligations and avoid any misunderstandings or disputes.

However, it’s important to note that CFR does have its limitations. For instance, it only covers transportation by sea and doesn’t include insurance coverage for potential loss or damage during transit. Additionally, buyers may face challenges when dealing with customs clearance, import duties, and other related expenses at their destination port.

When comparing CFR with other Incoterms like CIF (Cost Insurance and Freight) or FOB (Free on Board), there are distinct differences in terms of cost allocation and risk transfer. While CIF includes insurance coverage along with transportation costs, FOB places more responsibility on the buyer as they must arrange transport from the point of origin.

Choosing an appropriate Incoterm depends on various factors such as industry practices, logistics capabilities of both parties involved, desired level of control over shipping arrangements, and overall cost considerations.