Shipping goods across vast oceans can be a daunting task, especially when dealing with different regulations and requirements. Whether you’re a freight forwarder, an importer, or an e-commerce business, understanding the intricacies of shipping from France to Australia is crucial. This blog post aims to provide you with all the essential information you need to ensure a smooth and efficient shipping process.

Understanding Australian Customs Regulations

Navigating Import Regulations

Australia has stringent customs regulations that every logistics provider must comply with. Before shipping any goods, it’s crucial to understand the import regulations to avoid potential delays and penalties. Familiarize yourself with the customs documentation required, such as the Bill of Lading, Commercial Invoice, and Packing List. Accurate and complete documentation will streamline the customs clearance process.

Duty and Taxes

One of the main aspects to consider is the duty and taxes imposed on imported goods. The type of goods being imported, their value, and their country of origin determine the amount of duty payable. Australia uses the Harmonized System (HS) to classify goods, and each classification has its own duty rate. Additionally, the Goods and Services Tax (GST) applies to most imported goods at a rate of 10%.

Biosecurity Measures

Australia enforces strict biosecurity measures to protect its unique ecosystems. Certain goods, such as food products, plants, and animal-derived items, may require special permits and undergo rigorous inspections. Understanding these biosecurity requirements will help you avoid any complications during the import process.

Shipping Periods from France to Australia

Understanding Transit Times

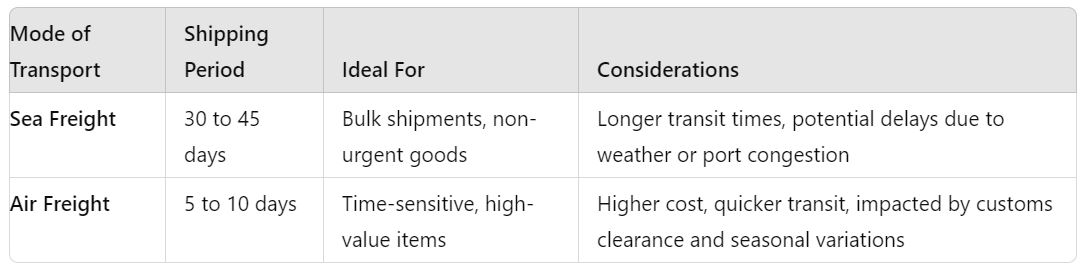

The shipping period from France to Australia can vary depending on several factors, including the shipping method and the specific routes taken. On average, shipping by sea freight can take between 30 to 45 days, while air freight is significantly faster, ranging from 5 to 10 days. It’s essential to plan your shipments well in advance to account for these transit times.

Influencing Factors

Several factors can influence the shipping periods, such as weather conditions, port congestion, and customs clearance processes. Seasonal variations, like holiday seasons or peak shipping periods, can also impact transit times. Keeping these factors in mind will help you set realistic expectations and avoid any disruptions in your supply chain.

Choosing the Right Shipping Method

Choosing the appropriate shipping method is crucial for balancing cost and speed. Sea freight is ideal for bulk shipments and non-urgent goods, while air freight is suitable for time-sensitive and high-value items. Consider your specific needs and the nature of your goods when choosing between these shipping methods.

VAT in Australia

`VAT Overview

`VAT Overview

Value Added Tax (VAT) in Australia, known as the Goods and Services Tax (GST), is a consumption tax imposed on most goods and services. The standard GST rate is 10%, and it applies to both domestic and imported goods. Understanding how VAT works is essential for accurate pricing and compliance.

GST on Imported Goods

When importing goods into Australia, GST is calculated based on the customs value of the goods, including the cost of shipping and insurance. The GST is payable at the time of importation and must be paid before the goods can be released from customs. Ensure that you include this cost in your pricing strategy to avoid any financial surprises.

Claiming GST Credits

Businesses registered for GST can claim GST credits for the tax paid on imports. To do this, you must hold a valid tax invoice and meet the eligibility criteria set by the Australian Taxation Office (ATO). Claiming GST credits can help reduce the overall cost of importing goods and improve your cash flow.

Remote Area Surcharge

What is a Remote Area Surcharge?

A Remote Area Surcharge (RAS) is an extra fee charged by shipping carriers for delivering goods to locations that are considered remote or difficult to access. In Australia, this can include rural areas, islands, and regions with limited infrastructure. The surcharge compensates for the increased costs and logistical challenges associated with these deliveries.

Determining Remote Areas

Shipping carriers have specific criteria for defining remote areas, and these criteria can vary between providers. It’s essential to check with your chosen carrier to understand which locations are considered remote and the applicable surcharge rates. Accurate information will help you calculate the total shipping costs more precisely.

Minimizing RAS Impact

To minimize the impact of the Remote Area Surcharge on your shipping costs, consider consolidating shipments to remote areas or partnering with local logistics providers. Efficient route planning and volume discounts can also help reduce the overall surcharge and improve cost-efficiency.

Restrictions

Prohibited and Restricted Items

Australia has a comprehensive list of prohibited and restricted items that cannot be imported or require special permits. These include hazardous materials, firearms, certain chemicals, and endangered species products. Familiarize yourself with this list to ensure compliance and avoid penalties.

Packaging and Labeling Requirements

Specific packaging and labeling requirements apply to certain goods, especially those subject to biosecurity regulations. For example, wooden packaging materials must be treated and certified according to international standards to prevent the spread of pests. Proper packaging and clear labeling will facilitate smooth customs clearance.

Compliance and Penalties

Non-compliance with import restrictions and regulations can result in severe penalties, including fines, shipment delays, and even confiscation of goods. It’s crucial to stay informed about the latest regulations and work closely with customs brokers and freight forwarders to ensure compliance.

Frequently Asked Questions (FAQ)

How long does shipping from France to Australia take?

The shipping period varies depending on the method. Sea freight takes 30 to 45 days, while air freight ranges from 5 to 10 days.

What documents are required for customs clearance in Australia?

Essential documents include the Bill of Lading, Commercial Invoice, and Packing List. Additional permits may be required for certain goods.

How is GST calculated on imported goods?

GST is calculated based on the customs value of the goods, including shipping and insurance costs. The standard GST rate is 10%.

What is a Remote Area Surcharge?

A Remote Area Surcharge is an additional fee for delivering goods to remote or less accessible locations in Australia.

How can I minimize shipping costs?

Choose the appropriate shipping method, consolidate shipments, and partner with local logistics providers to reduce costs.

Conclusion

Conclusion

Navigating the complexities of shipping from France to Australia requires careful planning and a thorough understanding of customs regulations, shipping periods, VAT, remote area surcharges, and import restrictions. By staying informed and working with experienced logistics partners, you can ensure a smooth and efficient shipping process.

If you have any specific questions or need further assistance, don’t hesitate to reach out to our team. We’re here to help you succeed in your international shipping endeavors.

`VAT Overview

`VAT Overview Conclusion

Conclusion