Global trade is the lifeblood of modern economies, and Brazil stands as a significant player in this arena. For entities involved in logistics, freight forwarding, and related industries, understanding Brazil’s top trading partners is essential. This blog post will take you through the key players in Brazil’s export and import landscape, providing valuable insights and statistics.

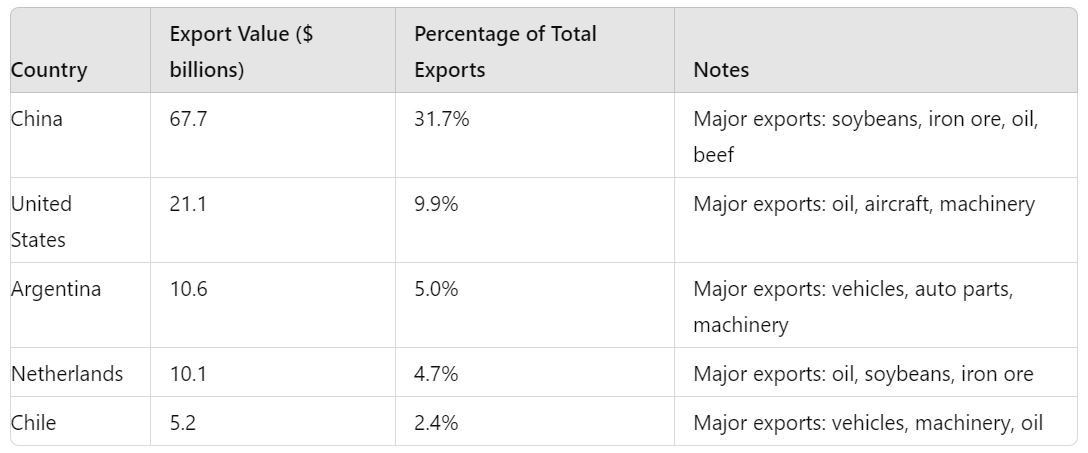

Top Export Partners

Top Export Partners

- China

- Value: $67.7 billion

- Percentage of Total Exports: 31.7%

- China is the largest recipient of Brazilian goods, with key exports including soybeans, iron ore, oil, and beef. This robust trade relationship is driven by China’s demand for raw materials to support its manufacturing and industrial sectors.

- United States

- Value: $21.1 billion

- Percentage of Total Exports: 9.9%

- The United States is a significant export partner for Brazil, with primary exports being oil, aircraft, and machinery. The diverse nature of these exports reflects the strong industrial and technological ties between the two nations.

- Argentina

- Value: $10.6 billion

- Percentage of Total Exports: 5.0%

- Argentina is a key regional partner for Brazil, with exports primarily consisting of vehicles, auto parts, and machinery. This trade relationship is crucial for both countries’ automotive and manufacturing industries.

- Netherlands

- Value: $10.1 billion

- Percentage of Total Exports: 4.7%

- The Netherlands serves as an important gateway for Brazilian goods into Europe. Major exports include oil, soybeans, and iron ore, which are essential for the Dutch and broader European industrial sectors.

- Chile

- Value: $5.2 billion

- Percentage of Total Exports: 2.4%

- Chile is a vital trade partner in South America, with Brazil exporting vehicles, machinery, and oil. This partnership supports Chile’s transportation and industrial infrastructure needs, strengthening regional economic ties.

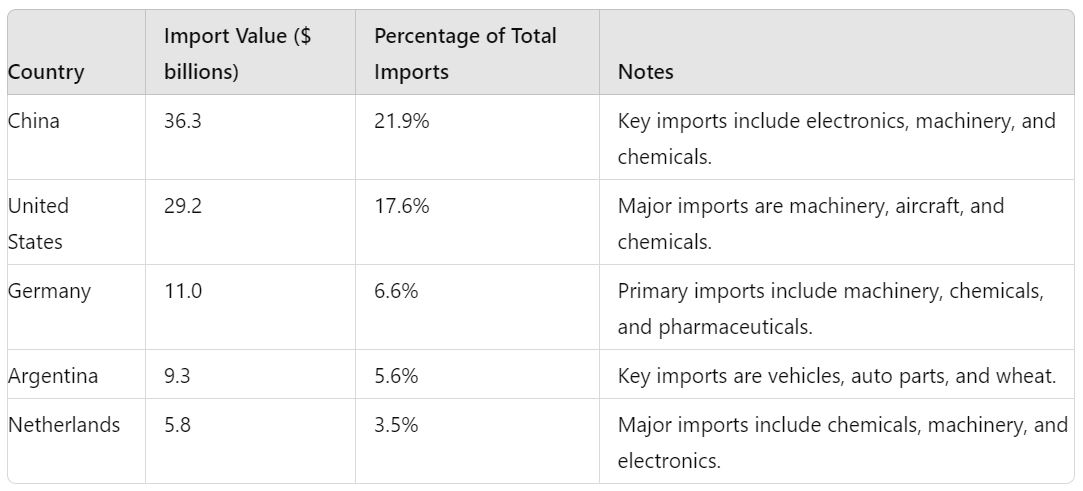

Top Import Partners

Top Import Partners

- China

- Value: $36.3 billion

- Percentage of Total Imports: 21.9%

- China is the largest supplier of goods to Brazil, providing essential imports such as electronics, machinery, and chemicals. This trade relationship is vital for Brazil’s industrial and technological sectors.

- United States

- Value: $29.2 billion

- Percentage of Total Imports: 17.6%

- The United States is a significant import partner for Brazil, supplying a diverse range of goods including machinery, aircraft, and chemicals. These imports are crucial for Brazil’s industrial and technological development.

- Germany

- Value: $11.0 billion

- Percentage of Total Imports: 6.6%

- Germany is an important supplier to Brazil, providing high-value goods such as machinery, chemicals, and pharmaceuticals. These imports support Brazil’s industrial and healthcare sectors.

- Argentina

- Value: $9.3 billion

- Percentage of Total Imports: 5.6%

- Argentina is a key regional supplier, exporting goods to Brazil primarily consisting of vehicles, auto parts, and wheat. This trade relationship supports Brazil’s automotive and agricultural industries.

- Netherlands

- Value: $5.8 billion

- Percentage of Total Imports: 3.5%

- The Netherlands is an important European partner for Brazil, supplying chemicals, machinery, and electronics. These imports are essential for Brazil’s manufacturing and technological infrastructure.

Trade Deficits and Surpluses

Brazil’s trade balance underscores both its economic strengths and areas that require attention. The country posted a substantial overall trade surplus of $50 billion, primarily driven by significant surpluses with China ($31.4 billion), the Netherlands ($4.3 billion), and Chile ($3.2 billion). These surpluses are largely attributable to high exports of commodities such as soybeans, iron ore, and oil. Conversely, Brazil faced notable trade deficits with Germany ($6.7 billion), South Korea ($3.2 billion), and Japan ($0.7 billion), largely due to imports of machinery, electronics, and vehicles. This balance highlights Brazil’s crucial role in global trade as both a major exporter of raw materials and an importer of industrial goods.

Continental Trade Distribution

A significant portion of Brazil’s trade is concentrated within the Americas, with approximately 29.8% of exports and 26.1% of imports involving North and South American countries. This includes major trade partners such as the United States and Argentina. Asia plays a crucial role in Brazil’s trade, accounting for 39.2% of exports and 29.7% of imports, with China being the most prominent partner. Europe also holds substantial importance in Brazil’s trade network, comprising 22.1% of exports and 21.4% of imports, involving key partners like Germany and the Netherlands. This distribution highlights Brazil’s strategic economic ties across multiple continents, emphasizing its integrated role in global trade networks.

Emerging Markets and New Partnerships

Brazil is continually seeking to expand its trade horizons. Emerging markets in Africa and Southeast Asia present new opportunities for Brazilian exports. Countries like India and Indonesia are increasingly becoming significant trade partners. This diversification ensures Brazil remains resilient in the global market, reducing dependency on traditional partners.

Sustainable Trade Practices

Sustainable Trade Practices

Sustainability is becoming a core aspect of Brazil’s trade policies. Efforts to reduce carbon footprints and promote eco-friendly practices are gaining traction. Initiatives include sustainable agriculture, responsible mining, and renewable energy projects. These practices not only enhance Brazil’s global image but also attract environmentally-conscious trade partners.

Technological Innovations

Technological advancements are revolutionizing Brazil’s trade dynamics. The adoption of AI, blockchain, and IoT in logistics and supply chain management is streamlining processes and enhancing efficiency. These innovations ensure that Brazil remains competitive in the global market, offering reliable and efficient trade solutions.

Government Initiatives

The Brazilian government is actively promoting policies to enhance trade. Initiatives like tariff reductions, trade agreements, and infrastructure development are creating a conducive environment for business. Programs supporting small and medium enterprises (SMEs) in international markets are also being rolled out, ensuring inclusive economic growth.

Conclusion

Brazil’s trade relationships are a testament to its strategic economic policies and diversified trade partnerships. For freight forwarding companies, logistics providers, importers, exporters, and related industries, understanding these dynamics is crucial. The opportunities and challenges presented by Brazil’s trade landscape offer valuable insights for businesses looking to expand their global footprint.

In conclusion, Brazil’s robust trade network underscores its pivotal role in the global economy. By leveraging these insights, businesses can strategically align themselves to harness the potential of Brazil’s dynamic trade environment. For more detailed guidance on navigating Brazil’s trade landscape, consider exploring further resources or connecting with us.

Top Export Partners

Top Export Partners Top Import Partners

Top Import Partners

Sustainable Trade Practices

Sustainable Trade Practices