In the intricate landscape of global trade, understanding the pivotal partnerships that drive economic growth is crucial. Argentina, with its rich resources and strategic geographical position, stands out as a significant player. This blog post aims to unravel the intricacies of Argentina’s top trading partners, providing valuable insights for freight forwarding companies, logistics providers, importers, exporters, and other industry stakeholders.

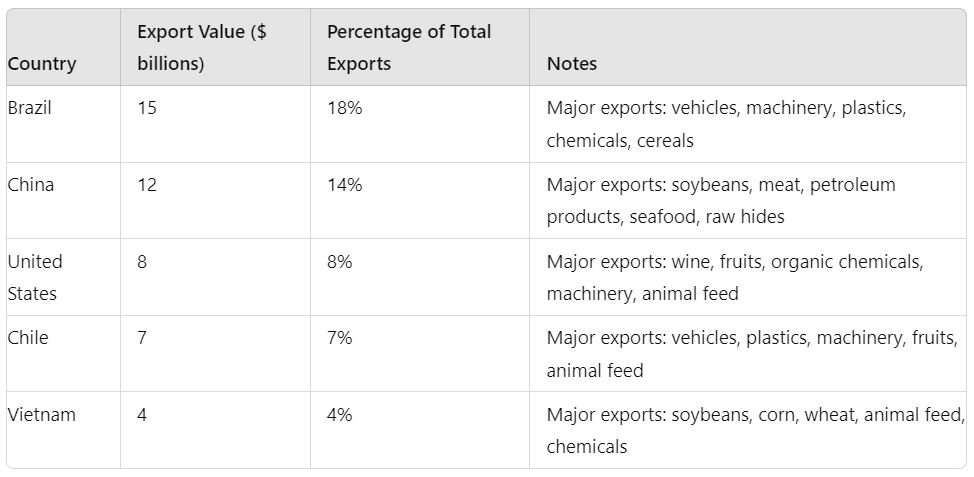

Argentina’s Top Export Partners

Argentina’s Top Export Partners

- Brazil

- Value: $15 billion

- Percentage of Total Exports: 18%

- Description: Brazil is Argentina’s top export partner, with major exports including vehicles, machinery, plastics, chemicals, and cereals.

- China

- Value: $12 billion

- Percentage of Total Exports: 14%

- Description: China is a key export destination for Argentina, primarily importing soybeans, meat, petroleum products, seafood, and raw hides.

- United States

- Value: $8 billion

- Percentage of Total Exports: 8%

- Description: The United States is a significant export partner, with Argentina exporting wine, fruits, organic chemicals, machinery, and animal feed.

- Chile

- Value: $7 billion

- Percentage of Total Exports: 7%

- Description: Chile is an important trade partner, with exports from Argentina including vehicles, plastics, machinery, fruits, and animal feed.

- Vietnam

- Value: $4 billion

- Percentage of Total Exports: 4%

- Description: Vietnam is a growing export market for Argentina, primarily receiving soybeans, corn, wheat, animal feed, and chemicals.

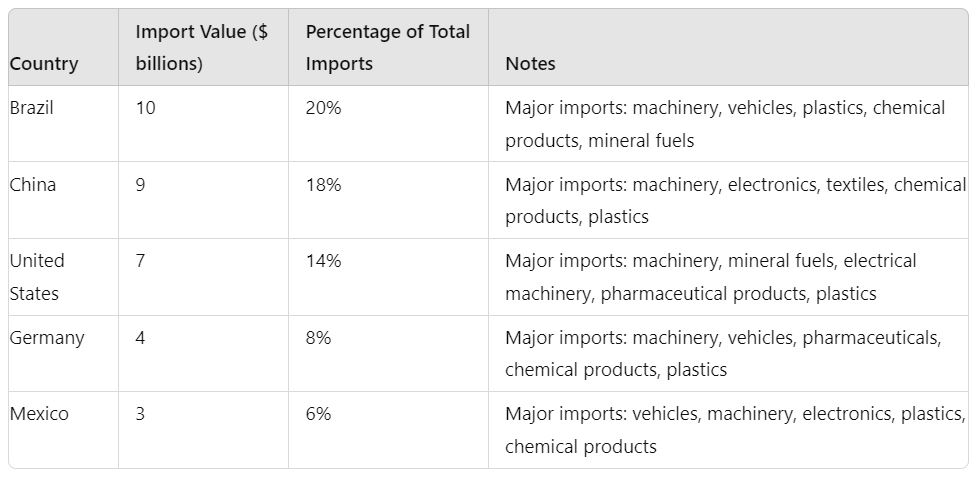

Argentina’s Top Import Partners

Argentina’s Top Import Partners

- Brazil

- Value: $10 billion

- Percentage of Total Imports: 20%

- Description: Brazil is Argentina’s top import partner, with major imports including machinery, vehicles, plastics, chemical products, and mineral fuels.

- China

- Value: $9 billion

- Percentage of Total Imports: 18%

- Description: China is a key import source for Argentina, primarily supplying machinery, electronics, textiles, chemical products, and plastics.

- United States

- Value: $7 billion

- Percentage of Total Imports: 14%

- Description: The United States is a significant import partner, providing Argentina with machinery, mineral fuels, electrical machinery, pharmaceutical products, and plastics.

- Germany

- Value: $4 billion

- Percentage of Total Imports: 8%

- Description: Germany is an important trade partner, with imports including machinery, vehicles, pharmaceuticals, chemical products, and plastics.

- Mexico

- Value: $3 billion

- Percentage of Total Imports: 6%

- Description: Mexico is a growing import partner for Argentina, supplying vehicles, machinery, electronics, plastics, and chemical products.

Argentina’s Trade Deficits and Surpluses

In 2023, Argentina’s trade balance highlighted its economic dynamics with an overall trade deficit of $15 billion, driven by substantial deficits with Brazil ($5 billion), China ($4 billion), and the United States ($3 billion) due to high imports of machinery, vehicles, electronics, and chemical products. However, Argentina achieved notable trade surpluses with Chile ($2 billion), Vietnam ($1.5 billion), and India ($1 billion), fueled by exports of agricultural products like soybeans, cereals, and meat, as well as vehicles and machinery. This pattern underscores Argentina’s role as a key exporter of agricultural commodities and a significant importer of industrial and technological goods.

Continental Trade Distribution

Continental Trade Distribution

A significant portion of Argentina’s trade is focused within South America, with about 26% of exports and 30% of imports involving neighboring countries, primarily Brazil and Chile. Substantial trade also occurs with Asia, accounting for 24% of exports and 27% of imports, mainly driven by trade with China, India, and Vietnam. Europe is important too, making up 20% of exports and 18% of imports, with strong ties to Germany, Italy, and Spain. North America represents 15% of exports and 12% of imports, particularly with the United States and Mexico. This distribution highlights Argentina’s strategic economic connections across continents and its vital role in global commerce.

Emerging Markets and New Partnerships

While Argentina has established strong trade relationships with key partners, it is also exploring emerging markets and new partnerships. Countries in Africa and the Middle East are becoming increasingly important destinations for Argentine exports, particularly in the agricultural sector. Additionally, Argentina is strategically positioning itself to tap into the growing markets of Southeast Asia, where the demand for agricultural products and raw materials is on the rise. By diversifying its trade portfolio and forging new partnerships, Argentina aims to reduce its reliance on traditional markets and enhance its global trade footprint.

Sustainable Trade Practices

In recent years, there has been a growing emphasis on sustainable trade practices in Argentina. The country is actively promoting environmentally friendly agricultural practices, such as precision farming and organic cultivation, to reduce its carbon footprint and enhance the sustainability of its exports. Additionally, Argentina is investing in renewable energy sources, such as wind and solar power, to support its industrial and manufacturing sectors. These initiatives not only contribute to environmental sustainability but also enhance the competitiveness of Argentine products in the global market, where there is increasing demand for eco-friendly goods.

Technological Innovations

Technological innovations are playing a crucial role in enhancing Argentina’s trade capabilities. The adoption of blockchain technology in supply chain management is improving transparency and traceability in the export of agricultural products. Additionally, the use of artificial intelligence and data analytics is enabling Argentine businesses to optimize their operations, forecast demand more accurately, and enhance customer satisfaction. These technological advancements are positioning Argentina as a forward-thinking trade partner, capable of meeting the evolving needs of global markets.

Government Initiatives

The Argentine government is actively implementing initiatives to support and enhance the country’s trade capabilities. Policies aimed at reducing trade barriers, improving infrastructure, and providing financial incentives to exporters are key components of this strategy. Additionally, the government is fostering international collaborations and trade agreements to open new markets and create opportunities for Argentine businesses. These initiatives are designed to enhance the competitiveness of Argentine products, attract foreign investment, and drive economic growth.

Conclusion

Conclusion

Argentina’s trade dynamics, characterized by strong partnerships with countries like Brazil, China, and the United States, as well as emerging markets in Asia and beyond, highlight the country’s strategic role in global commerce. The focus on sustainable trade practices, technological innovations, and government support further enhances Argentina’s position as a reliable and forward-thinking trade partner. For industry stakeholders, understanding these trade dynamics is crucial for navigating the complexities of international trade and seizing opportunities in the global market. To explore more about Argentina’s trade landscape and how you can leverage these insights for your business, feel free to connect with us. Together, we can drive your success in the world of global trade.

Argentina’s Top Export Partners

Argentina’s Top Export Partners Argentina’s Top Import Partners

Argentina’s Top Import Partners Continental Trade Distribution

Continental Trade Distribution Conclusion

Conclusion