If you are someone in the import/export business, then you have probably heard about the Red Sea shipping crisis caused by Yemen Houthi Rebels. It may be confusing, as this is progressing news, having updates almost daily.

To better understand, here are a few things you should know and the impact it is having on global trade.

What is the Red Sea?

Lying south of the Suez Canal, the Red Sea plays a vital role in maritime trade. It is the world’s most densely packed shipping channel, covering about 12% of the global trade and adding to 30% of the global container traffic. Bordering the Red Sea are countries – Yemen, Saudi Arabia, Egypt, Sudan, Eritrea, and Djibouti.

Suez Canal is a 192-kilometre-long artificial sea-level waterway in Egypt, connecting the Mediterranean Sea. Its unique geographic location makes it the shortest maritime route from Asia to Europe.

Passing through the Suez Canal is the most favored route for shipping companies. It reduces fuel consumption and improves the transit time for an efficient supply chain. As per Statistica, 123.5 million metric tons of goods passed the Suez Canal Link in January 2023.

What is the Red Sea Shipping Crisis?

Also dubbed as the United States–Iran proxy war, the Red Sea Crisis has been ongoing since October 2023. The Red Sea attacks caused by the Iran-backed Houthi rebels that started in November 2023 stirred a major disruption in the Suez Canal Shipping Route.

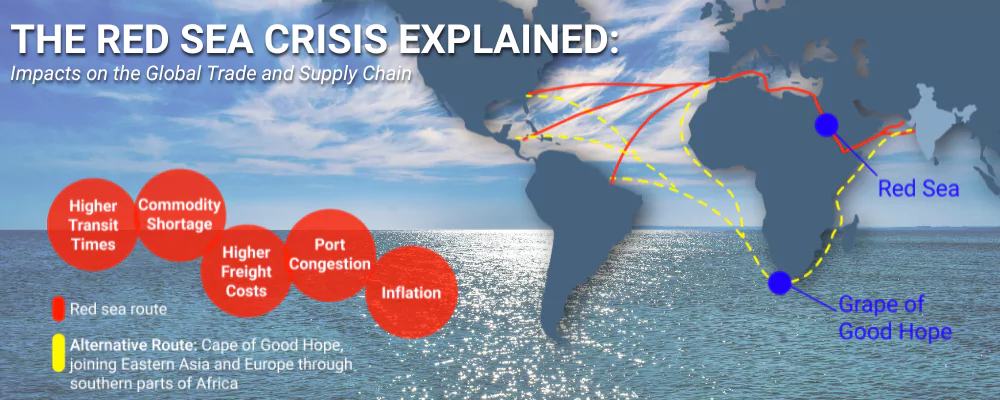

These attacks near the Bab al-Mandab Strait have compromised the safety of seafarers, obliging shipping and maritime companies to take extra precautions. Given the increased number of attacks, shipping companies are forcing ship reroutes to the southern tip of Africa – Cape of Good Hope, an extremely longer alternate route.

The Red Sea Shipping Crisis has increased the transit time for voyages, causing higher freight prices. Also drastically affecting a huge percentage of the global trade, the transit of Container ships is down 67% compared to the previous year.

Who are the Houthis and why are they attacking now?

Yemen Houthis are Iran-backed rebels who consider Israel as their enemy. When the long-range ballistic miles at Israel seemed ineffective attacks, as Saudis and we intercepted some US, the rebel group opted for a change in strategy focusing their attention on attacking commercial ships en-route to Israel.

While initially saying that only Israel-flagged ships were targeted, attacks on non-Israel affiliated ships were still reported.

How will this disruption affect Global Trade?

The turmoil of the Red Sea Shipping Crisis is compromising a huge part of global trade, posing a severe blow, not limited to shipping companies alone. These effects have rippled, affecting different factors of the supply chain:

1. Higher Transit Times

Aware that the Red Sea Shipping Crisis is not laying off anytime soon, shipping giants like MSC, Maersk, and Hapag Lloyd have expressed they are rerouting vessels to the Cape of Good Hope route until the Red Sea attack situation has been mitigated.

These detours will prolong transit times by 30%. With vessels being rerouted to longer routes, the increased transit time will also prompt a shortage of certain products and commodities that go through Asia and Europe. The possibility of spoilage is also being deliberated.

2. Commodity Shortage

Commodity giants IKEA, Abercombie, and Fitch, have already advised consumers about the delays and probable availability constraints, in light of the Red Sea Shipping Crisis. With Europe heavily relying on aluminum imports, the shortage is more likely to surface.

Meanwhile containerized Agri commodities are also disrupted, leading to potential tightness in domestic markets within the African region. Some other impacts on commodities are highlighted below:

- Wheat shipments fell by almost 40% in the first half of January.

- Robusta prices have risen 9%, the highest in the last 16 years.

- India’s sunflower oil imports are expected to decline, brought about by the soaring freight prices.

- With China and other Asian countries as critical exporters, the minor metals market in Western Countries is hitting higher prices.

With the ongoing crisis, these prominent commodities that transit through the Suez Canal are the foremost affected.

3. Higher Freight Costs

Ocean freight costs have been surging, amidst the Red Sea Disruption. Charges to shipping containers through the Red Sea, ballooned by 250%. A 40-foot container passing China to Europe is charged an average of $4,000, way higher than the estimated $1,148 pre-November 2023.

Shifting container routes to the Southern tip of Africa (Cape of Good Hope) is a strategic approach most shipping companies are taking to avoid the attacks. Transiting here, however, will result in an extra 3,500 nautical miles and $2 million in fuel costs. With added transit days, so are fuel costs, translating to added freight costs for shippers.

4. Port Congestion

The COVID-19 incident left a learning curve for the shipping industry, increasing container volume in general, therefore container shortages won’t likely be a problem. While container equilibrium is still balanced, other causes of port efficiency during the pandemic-era congestion are resurfacing.

The shortage of chassis, rail car imbalances, and increased demand could also swell up container congestion, amidst the Red Sea Shipping Crisis.

5. Inflation

With the Red Sea Shipping Crisis spiking fuel prices, a domino effect is set to wind up. Following the impact on shipping companies, and businesses, consumers are next in line. 2024 was supposed to be the year inflation is expected to dissipate, however, the persistent Red Sea attacks are causing chokepoints in global trade.

The sky-high shipping prices translate to price hikes on certain goods, impeding the fight to downswing inflation. If the Red Sea Shipping Crisis persists, consumers are to expect higher inflation.

What should shippers do?

Shippers should talk and create plans with their logistics provider, especially considering the Red Sea Shipping Crisis. Freight Forwarders have the best link to shipping lines, and hiring a good and efficient forwarder will help you better understand the situation, its impact, and what you can do to mitigate it.

Planning your shipments, and securing the volumes ahead of time, ensures you get ship capacity, and that your goods are transported in time. It’s best to ask for the latest freight quotation to gauge how your company is planning to address the added costs.

If you’re looking for trusted Freight Forwarders to discuss your needs, amidst the Red Sea Shipping Crisis, Pangea is an International Freight Network of first-class Air and Sea Freight Specialists with agents in all main airports/seaports worldwide.

Find your Freight Forwarder Partner here!